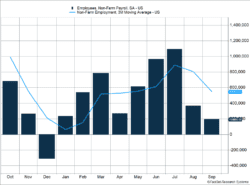

For the second consecutive month, the U.S. job market created far fewer jobs than expected. September’s report showed only 194,000 jobs were created, missing expectations by nearly 300,000. A deeper look at the data shows the report wasn’t as bad as indicated by the overall number.

Key Points for the Week

- U.S. nonfarm payrolls rose 194,000 in September, missing expectations for an increase of 479,000. Weak hiring in private and public schools undercut employment growth.

- Unemployment fell to 4.8% in part because the number of people in the labor force declined in response to the Delta variant.

- The U.S. trade deficit grew to a record $73 billion as imports have grown 16% since the start of the pandemic and exports have only grown 4%.

Private payrolls climbed 317,000, and the previous two months were revised a combined 169,000 higher. The government sector underperformed expectations. On a seasonally adjusted basis, government payrolls dropped by 123,000 as public schools did not hire as many staff as expected. Education payrolls also declined in the private sector.

Moving goods around remains a major issue. The U.S. trade deficit has grown to a record $73 billion. Imports have surged 16% since the pandemic began, as sending out stimulus checks to individuals caused a surge of consumption, and some of that money inevitably went to purchase foreign goods. Other countries did not have the same focus, and a similar benefit has not reached the U.S. Exports have only grown 4% since the start of the pandemic. Concerns about ports unloading ships and the lack of transportation in some countries is also weighing on expectations for economic growth.

A modicum of bipartisanship pushed risk of government default out two months. The S&P 500 jumped 0.8% in another volatile week. The MSCI ACWI added 0.7%. Concerns about increasing long-term interest rates contributed to a slide in bond prices. The Bloomberg U.S. Aggregate Bond Index sagged 0.8%. The Consumer Price Index and retail data lead a busy week of economic releases.

Figure 1

Time of the Season

The September jobs report released on Friday signaled a stark decline in hiring. It missed estimates by a large margin. Expectations were for 479,000 jobs to be created, but the reported number was less than half that at only 194,000. That was also the lowest jobs number posted so far in 2021, likely caused by a combination of the Delta variant slowing hiring decisions and some employers being unable to find workers.

The report wasn’t as weak as it looked. Data for the previous two months was revised upward, with August up to 366,000 (an increase of 131,000) and July up to 1,090,000 (an increase of 38,000). While September’s jobs number was much lower than expected, the unemployment rate decreased to 4.8% from 5.2% in August. This was due partly to some workers choosing to end their job searches and exit the labor force.

There was a stark contrast between private and government payrolls in September. Private payrolls were closer to expectations. September private payrolls increased 317,000 compared to expectations for 470,000 new jobs. If the previous month’s revisions are included, that is close to expectations. The main detractor from private hiring was in private education, which saw a decrease of 18,900 jobs. Reduced educational hiring depressed government hiring even more. Government payrolls fell by 123,000 in September. The largest detractor was from state and local education.

Some of the most significant factors affecting the number of education jobs are the seasonal adjustments used in the reports. Seasonal adjustments are used to simplify comparisons between a series of months. Schools hire a lot of workers in September to fill key rolls not needed when school is out of session. Because those hires occur every year, the government adjusts the statistics to reflect normal seasonal patterns. Without the seasonal adjustment, government payrolls would have been 877,000 higher instead of 123,000 lower.

So rather than saying public schools are employing 123,000 fewer people than last month, it would be fairer to say they added 123,000 fewer people between August and September, assuming the overall job market was unchanged. The effect works in the opposite direction. Leisure and hospitality payrolls would have fallen 413,000 instead of rising 74,000 because the summer travel season ended.

Seasonal adjustments remain the right way to analyze data even though COVID-19 has made seasonal adjustments more difficult. For instance, if a school district started two weeks later than normal, it might create a big miss one month and a big increase the next as hiring didn’t follow the normal seasonal pattern. The Bureau of Labor Statistics noted the challenges with making seasonal adjustments during the pandemic:

“Recent education employment changes are challenging to interpret, as pandemic-related staffing fluctuations in public and private education have distorted the normal seasonal hiring and layoff patterns.”

Seasonal adjustments are one of the reasons we look at many aspects of the data, rather than just the surface report. Our goal is not just to stay on top of the data, but to get to the bottom of it.

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.bls.gov/news.release/archives/empsit_10082021.htm

https://theovershoot.co/p/the-delta-jobs-slowdown

Compliance Case # 01157333