Divorce Planning

There’s no question divorce is one of the most stressful and emotionally- charged experiences people may encounter in their adult lives. However, it is possible to get through a divorce with your self-esteem, finances and future intact. The key is careful and deliberate planning. Download G …

Blended Family Finances: What to Consider When Getting Remarried

By Tom Fridrich, JD, CLU, ChFC®, Senior Wealth Planner Blended families, composed of couples who bring children from previous relationships together, have become increasingly common in today’s society. While blending families brings joy and new opportunities, it also can create comple …

Tax Planning Strategies for Executive Compensation

By Mike Valenti, CPA, CFP®, Director, Tax Planning Corporate executives often receive the brunt of the U.S. tax system. Typically, most or all of their income is W-2 income and subject to the higher ordinary tax rates as well as FICA taxes. W-2 employees currently are unable to deduct home …

Tax Planning for Executive Compensation

Tax planning for executive compensation doesn’t have to be confusing. Watch our webinar: Tax Planning for Executive Compensation with Carson’s Director, Tax Planning Mike Valenti and Wealth Planner Michael Gruidel, now available on-demand.

Executive Compensation Plans: Common Elements

Executive compensation plans can be used to attract, retain and reward high value employees. We’ve put together helpful information to know if you’re ever offered one of these plans through your employer. Download the checklist today to get started.

Stock Options, Explained: Incentive Stock Options vs. Non-Qualified Stock Options

Companies may grant employees stock options as a form of noncash compensation. This allows the employees to purchase shares of the employer’s stock at a given price after a predetermined period of time has passed. The intent of stock option compensation is to align the interests of the empl …

6 Tips to Create a Healthier Relationship With Money

Does the word “sale” send you running to your wallet? How many half-priced clothes hang in your closet with the tag still on? How many uncomfortable shoes did you buy solely because they were on sale? When thinking about money, do you feel stressed? Tense? Controlling? Confused? Like you ha …

Investing in Your Child’s Financial Future: Helping Kids Develop Strong Money Management Skills

Gaining financial literacy at a young age is a vital key to finding financial freedom later in life. Give your kids the lessons they need now to make better decisions about money in the future.

What Documents You Should Provide to Your Tax Preparer

Mike Valenti, CPA, CFP®, Director of Tax Planning Tom Fridrich, JD, CLU, ChFC®, Senior Wealth Planner It’s January, so it’s officially tax season! One of the most common client questions heard by tax preparers is, “So, what do you need from me?” The short answer to that question is often, “ …

10 Tax Planning Tips That Could Reduce Your Taxes

There’s more to tax planning than you think. Do you understand how each of your accounts are taxed? How did you set up your retirement plan? Have you considered an HSA? Take control of your taxes and how they fit into the big picture. Check out these income tax planning tips. Click here to …

How to Leverage Tax-Advantaged Accounts in 2023

Kevin Oleszewski, CFP®, MST, EA, Senior Wealth Planner As you’re setting your new year’s goals, one that should top everyone’s list is increasing your savings. After all, we’ve recently seen inflation at work, reminding us that even everyday essentials can bust budg …

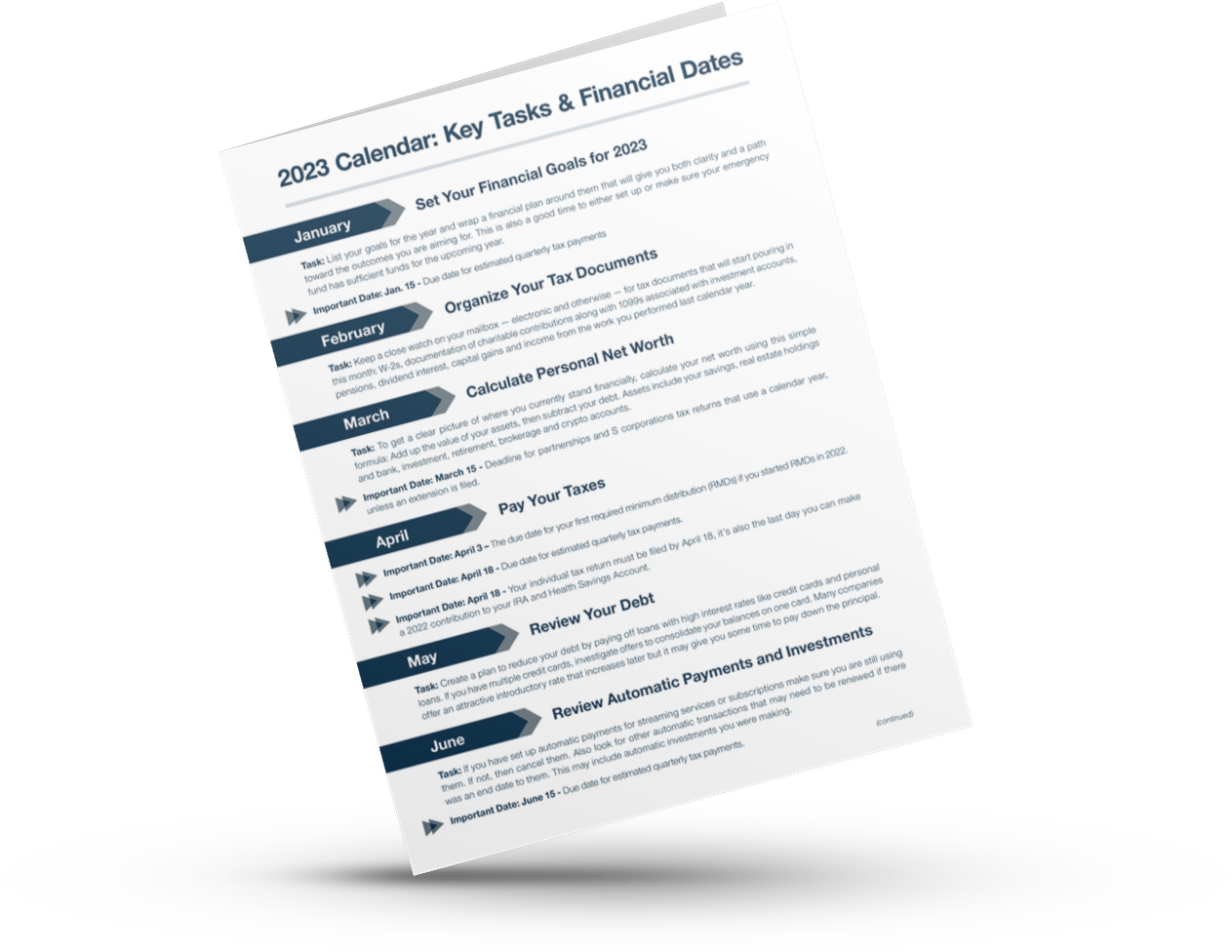

COMPLIMENTARY RESOURCE

2023 Calendar: Key Tasks & Financial Dates

Tackle 2023 with this month-by-month financial task list. We’ve also included important dates so you won’t miss key deadlines.