The SECURE Act is getting more press attention than retirement accounting has received in… well, probably ever, and was in the news all summer. It’s still being slowly digested by Congress but could change the landscape of retirement finance once it’s enacted. In short, the SECURE Act says if you inherit a retirement account, you have to withdraw the whole balance (in required minimum distributions or otherwise) in ten years or less.

The SECURE Act is essentially a move by Congress to create tax revenue, and contracts the time you can take distributions for that account. In the past, inherited retirement accounts were typically stretched out by the benefactor into supplemental income for thirty years or so in order to minimize the tax penalty. The SECURE Act takes that stretch privilege away.

So, what’s to be done? You don’t want Uncle Sam cutting into your kids’ inheritance, you want your legacy to be a gift, free and clear. Let’s look at one strategy today: the backdoor Roth conversion, and see how it could work even if the SECURE Act passes.

What is a Roth IRA?

With tax implications in mind, the Roth retirement system was born in Washington itself in the late nineties. Senator William Roth worked on the Taxpayer Relief Act of 1997, which established Roth IRAs and 401(k)s – both now staples of savings plans nationwide. The SECURE Act brought retirement savings into reach for the middle class by capping the income levels and offering a tax-smart approach to retirement.

Roth vehicles are the after-tax version of the traditional IRA, allowing owners to pay taxes on the front end and withdraw tax-free in those retirement years when every dollar counts. For those who don’t approach retirement with independent wealth, the Roth was and continues to be a lifesaver.

In Through the Out Door

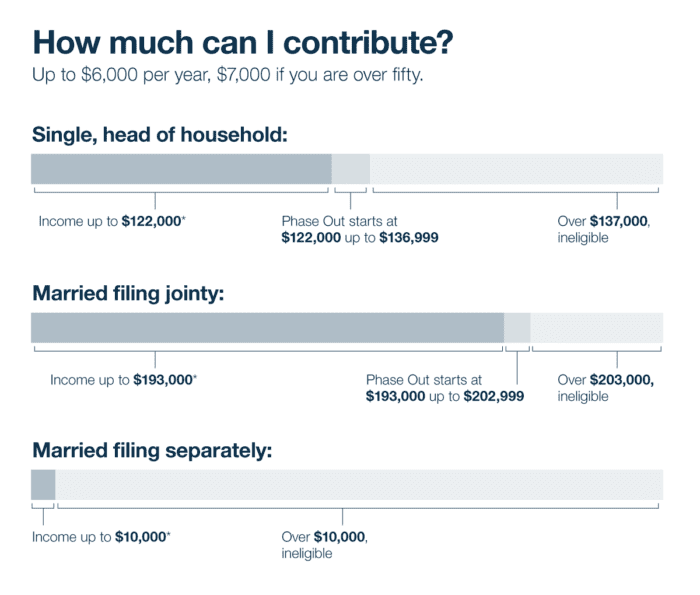

Roth IRAs have income limits that are important to know:

If you fall outside these parameters, you’re ineligible to benefit directly from a Roth IRA. Your direct avenue is a traditional IRA in which you’d be taxed on withdrawal.

The Roth backdoor conversion gives you a way to circumvent the income limits and still enjoy the tax-free growth of a Roth. While there are limits on what you can make to a Roth, and how much you can put in that Roth, there are no limits on the amount your conversion can be.

The basic mechanics are as follows: invest in a traditional IRA and “convert” it to a Roth IRA. This rollover will incur taxes, of course, but then the money will be in a Roth, teeing up for tax-free withdrawals, no matter how much it grows.

One thing to keep in mind here is that you can only do one Roth IRA conversion per year, so make it count. Planning ahead is key. You can contribute to your Roth IRA up to the limit, and then do the one-time annual conversion for the rest of your retirement nest egg from traditional to Roth.

The end goal of all this investing and converting is to help protect your retirement money from further taxation. This is especially important when it comes to RMDs, and even more so with an inherited account if the SECURE Act passes.

Charles and Jane, An Example

Let’s consider a long-term example. Charles, a successful car dealership owner, leaves his daughter Jane an $800,000 IRA. Jane is a hospital administrator who makes $120,000 a year and just turned 45. In the old days, Jane would be smart to piece out this IRA one year at a time, roughly $20,000 annually over 40 years – a nice little extra income that won’t put her in a higher tax bracket.

Under the SECURE Act, Jane would have to take the $800,000 at something like $80,000 annually for those years, which bumps her to $200,000 per year, well within the 32% tax bracket. The distribution doesn’t have to be this uniform, she just has to take that money out within ten years. The outcome of it is a lot more taxes on that inheritance, which Charles never meant to happen.

The Roth IRA conversion can help Charles plan ahead for this. If the money is converted to a Roth strategically every year for several years (or all at once), then it’s out of reach of taxes. Even if the SECURE Act passes and forces Jane to take the money out in a decade, it’s untaxed. Charles pays the taxes himself, before growth, and it takes a future (and larger) tax burden off his daughter.

Maximize Gift, Minimize Friction

Legacy planning, whether it involves Roth IRA conversions or not, is more complex than a deathbed dictation to a secretary. It takes planning and strategy to maximize your gift and minimize the friction of receiving it. Your financial advisor can guide you with a timeline and keep you up to date on the slow movements of Washington where the SECURE Act is in process.

Need an advisor who puts your interests first and can help you plan for today as well as tomorrow? Set up a free consultation today!

For a comprehensive review of your personal situation, always consult with a tax or legal advisor. Neither Cetera Advisor Networks LLC nor any of its representatives may give legal or tax advice.

Distributions from traditional IRAs and employer sponsored retirement plans are taxed as ordinary income and, if taken prior to reaching age 59½, may be subject to an additional 10% IRS tax penalty. Converting from a traditional IRA to a Roth IRA is a taxable event. A Roth IRA offers tax free withdrawals on taxable contributions. To qualify for the tax-free and penalty-free withdrawal of earnings, a Roth IRA must be in place for at least five tax years, and the distribution must take place after age 59½ or due to death, disability, or a first time home purchase (up to a $10,000 lifetime maximum). Depending on state law, Roth IRA distributions may be subject to state taxes.